There’s an old saying that you shouldn’t “put all of your eggs in one basket”. It may not necessarily have been in terms of investing, however, it’s the perfect way to describe the importance of asset allocation in your investment strategy.

We put – asset allocation as a first step to investing!

This has also been the need of an hour considering the markets in India and across the globe strongly feel the hit due to COVID-19 pandemic crisis which may translate from health crisis to possibly worst ever financial crisis. During this time, if assets are allocated properly i.e. are in sync with one’s objective of investing then one can possibly sleep well!

What is an asset allocation?

Asset allocation may sound like a fancy financial jargon, but in simple terms, it just means spreading your investment money in different asset classes like equity, debts, cash, gold, etc.

As mentioned. asset allocation should be the starting point while building your investment portfolio.

How is asset allocation beneficial?

By spreading your investments in different classes of assets, it provides an opportunity to diversify the portfolio thereby minimizing the risk of losses linked with one particular class of asset.

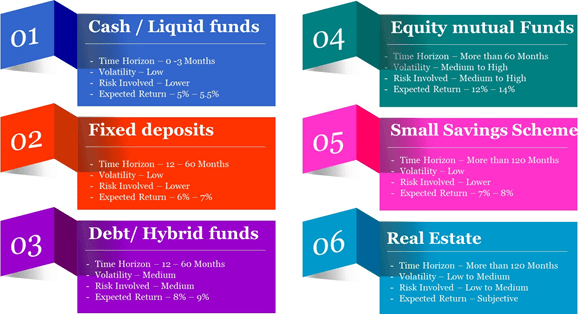

Just to give a simple example – Equity markets in India are down YTD by ~21% (and this after meaningful recovery in last one month). Assuming, your entire portfolio is in equity, then you would have lost approx. 21% (subject to performance of your actual portfolio). During this time, if you need some liquidity then you would not have any other option but to sell some part of your equity portfolio resulting into booking of actual losses. Had your assets allocation being proper, some part of liquidity issue may have been solved from the emergency fund created or by redeeming debt fund without selling equity. Also, it may be worth to understand that each asset class has different risks attached, return expectation, volatility, liquidity, etc. and go through cycles. The graphic below captures certain nuances of each asset class:

Considering above, a long-term goal can be achieved by having more aggressive assets such as equity mutual funds, while it is better to invest in safer assets to achieve short term goals. This balance is brought about by asset allocation. Here, it may be worthwhile to note in order to avoid confusion that diversification is different than asset allocation.

Is allocating assets a complex task?

As there are ample options available to invest, we now look at the aspects which are relevant to decide how much one should invest and allocate funds in each of the asset class.

General rule

As a rule, experts suggest that, one should allocate his assets in (100 – your age) format. Which means, the total that you get after reducing your current age from 100, is the percentage of the amount that you should invest in debt instruments and the rest is to be invested in equity.

For e.g., Mr. X is 25 years old, so accordingly, the percentage received is 100-25 = 75. Thus, 75% of his total investment portfolio should include equity-based instruments and 25% of his investment portfolio should include debt-based instruments.

The younger you are, the more risk you are capable of taking and higher should your % of equity allocations

This is simple technique which one can follow. Of course, there are questions as to where one should further allocate within the 75% bracket (i.e. direct equity stocks or equity mutual funds or ULIPs, etc.) and balance 25% bracket in debt (i.e. small savings scheme, debt funds, etc.)

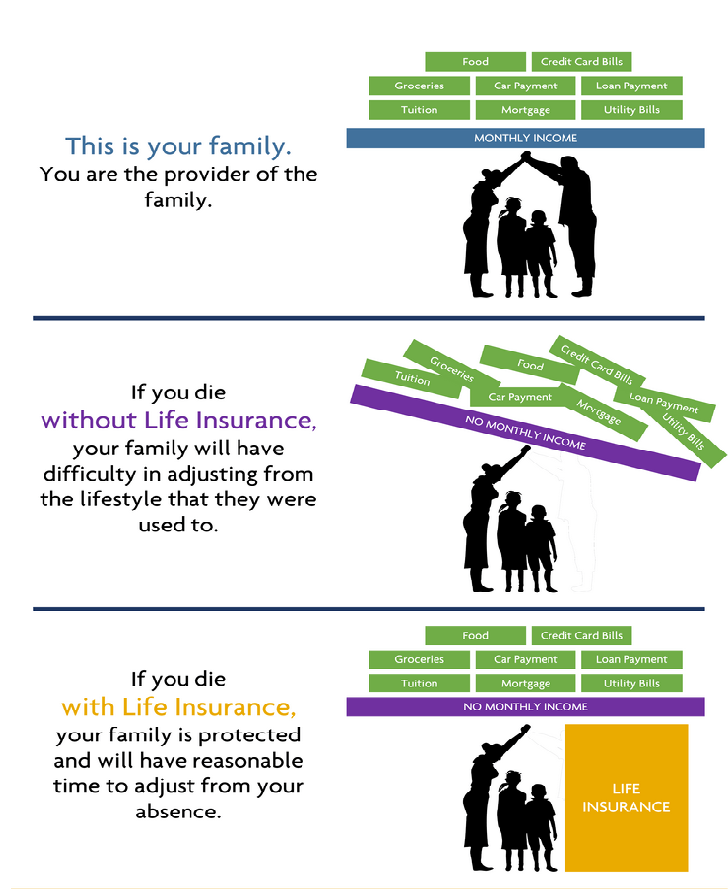

Also, there are few unanswered questions like how much emergency fund one should have, how muck risk coverage one should have (term insurance, health insurance, etc.), how much investment one should have in gold and real estate, etc.

Thus, it may be imperative to note that there is no fixed rule on how an investor should allocate his assets, however, following factors will assist an investor in deciding the right asset of allocation.

Factors relevant to decide asset allocation

- What is the objective of the investment goal? (e.g. investment for life, marriage goal, kids’ education, retirement, etc.)

- What is my time horizon? (1 year, 5 years, 10 years, etc.)

- What is my risk appetite? (I am fine if my portfolio is down by ~21%)

- What is my level of income, sources of income and how much I can invest for the goal

- What is my preference for liquidity? (Do I need immediately, after some time, etc.)

It is important to understand that the fundamental goal of investing is not to simply invest the money just for the sake of investing. It is to invest based on the requirements. If one is clear with the requirements, one can easily choose the ideal asset class for investment needs and thereby having overall right asset allocation. It is good to take help of financial advisor to plan the requirements as well as right asset allocation.

Once asset allocation is done – What next?

While investing is important, allocating your investments is even more important, assessing your investment periodically is extremely important for your wealth. There is no need to check the prices on every day or every week or every month basis of your portfolio, but at least it is important to review every 6 months or a year.

During such assessments, it is imperative to understand whether the investments are performing as per expectations, whether asset allocation is in place (it may change due to fluctuation in prices of assets wherein one has invested), whether there is need to find new avenues for investment or whether there is any need to discard an existing investment if things have not moved as per plan. There should be a structured review process the details of which we will cover some other day!

Who does not need asset allocation?

World’s richest investor, Warren Buffet has different view. According to him – “Put all your eggs in one basket and watch the basket very careful”.

In our view, this is true if someone understands the basket and can spend enough time and put enough efforts to watch that basket closely and carefully, otherwise, diversification through right asset allocation will not only help in preserving wealth but also generating it over a reasonable period of time.

Conclusion

Bad investment decisions, it is said, arise mostly from bad asset allocation. If, as investors, we get the asset allocation decision right, then we greatly reduce the chances of our investments turning bad. Please get in touch with us at manifeswealthadvisory@gmail.com in case of any further clarifications.